how are annuities taxed to beneficiaries

Annuities are products that provide a fixed income stream. Charitable contributions in excess of their respective deduction limits can generally be carried forward and deducted for up to five years.

Annuity Tax Consequences Taxes And Selling Annuity Settlements

A step up in basis will be provided to beneficiaries of annuities purchased before October 21 1979 upon the original contract owners death.

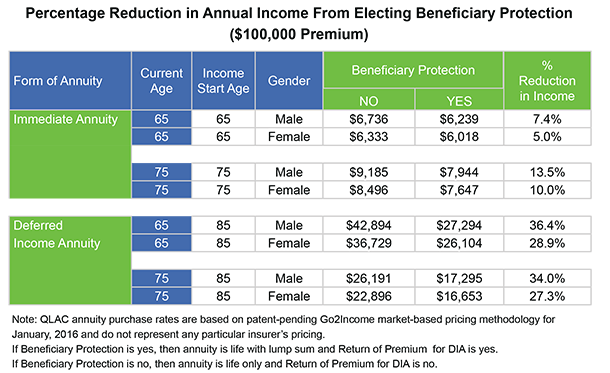

. They are highly customizable and can offer tax advantages payment periods tailored to your needs protection against losing your initial investment and options to transfer money to your beneficiaries. A death benefit is a payment triggered by the death of an insured individual. Death benefits are associated with life insurance policies.

We can consider an annuity then. Legacy Death benefits and legacy options as well as federal tax law dictate how assets will be distributed to beneficiaries. Charitable Remainder Annuity Trust.

However taxes may apply for insurance policies embedded in tax-advantaged plans. Alice is a single taxpayer who has 200000 of AGI for 2021In June of 2021 Alice makes a cash contribution of 150000 to her donor-advised fund a 50 Limit Organization. Here Alice will be allowed to deduct up to 60.

Some previously purchased contracts may be eligible to receive favorable tax treatment. Annuities complement other retirement plans and depending on what type you select they may provide guaranteed lifetime income opportunities for tax-deferred growth guaranteed yield downside protection market. Consumers often use annuities to guarantee income for life and to help fund retirement.

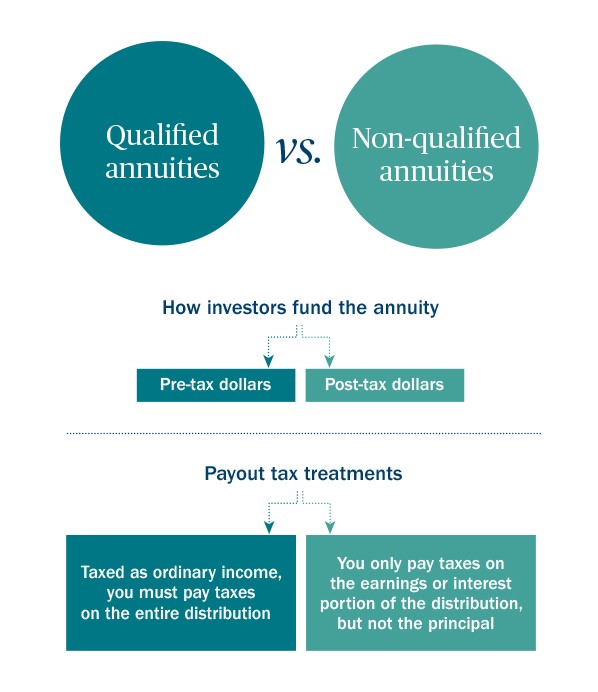

In some cases death benefits are completely tax-free for beneficiaries. Annuities are contracts between you and an insurance company that can provide a unique combination of insurance and investment features. These annuities earn tax-deferred interest until the income stream is turned on.

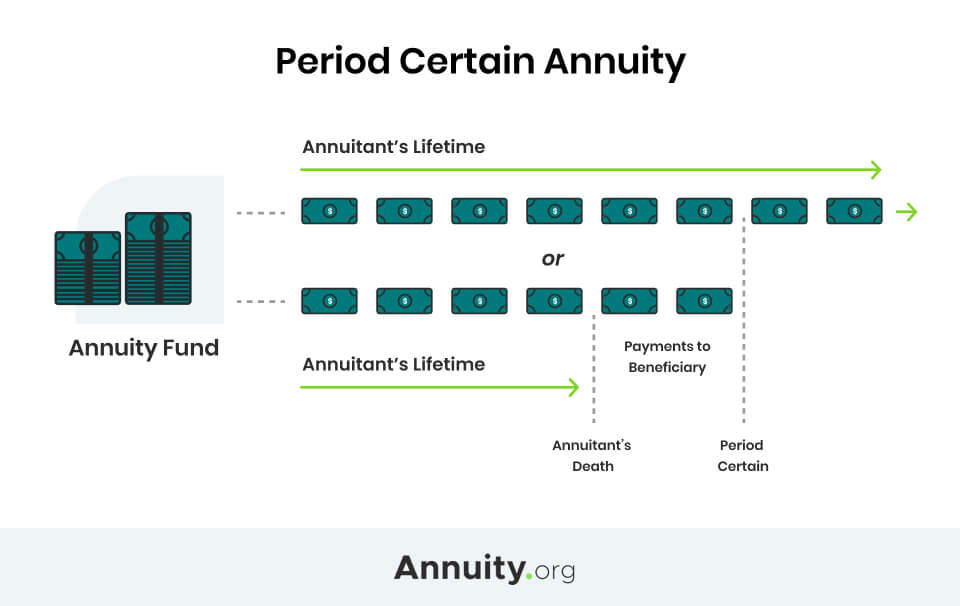

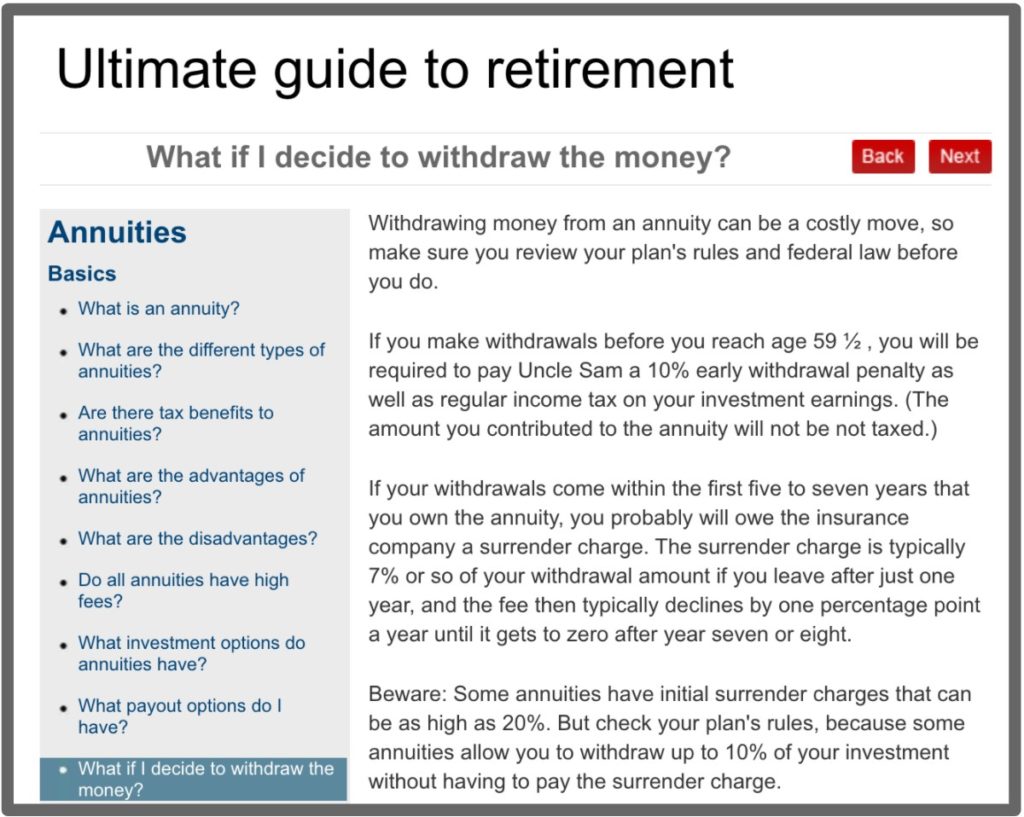

Many companies sell deferred annuities with flexible income start dates. If any funds are paid to the taxpayer all or part of those funds may be taxed as income depending on the gains in the original contract. Annuities have a death benefit that is a protected value.

Withdrawals from annuities purchased prior to August 14 1982 are subject to the first in first out treatment. Give my contact information to your wife or beneficiaries or executor of your estate and tell them to call me after you are gone when your wife needs income. A type of gift transaction in which a donor contributes assets to a charitable trust which pays an annuity designed to leave a substantial proportion of the.

What Is An Annuity How Are Income Annuities Different Income Annuities For Dummies

Annuity Beneficiaries Inheriting An Annuity After Death

Taxation Of Annuities Ameriprise Financial

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

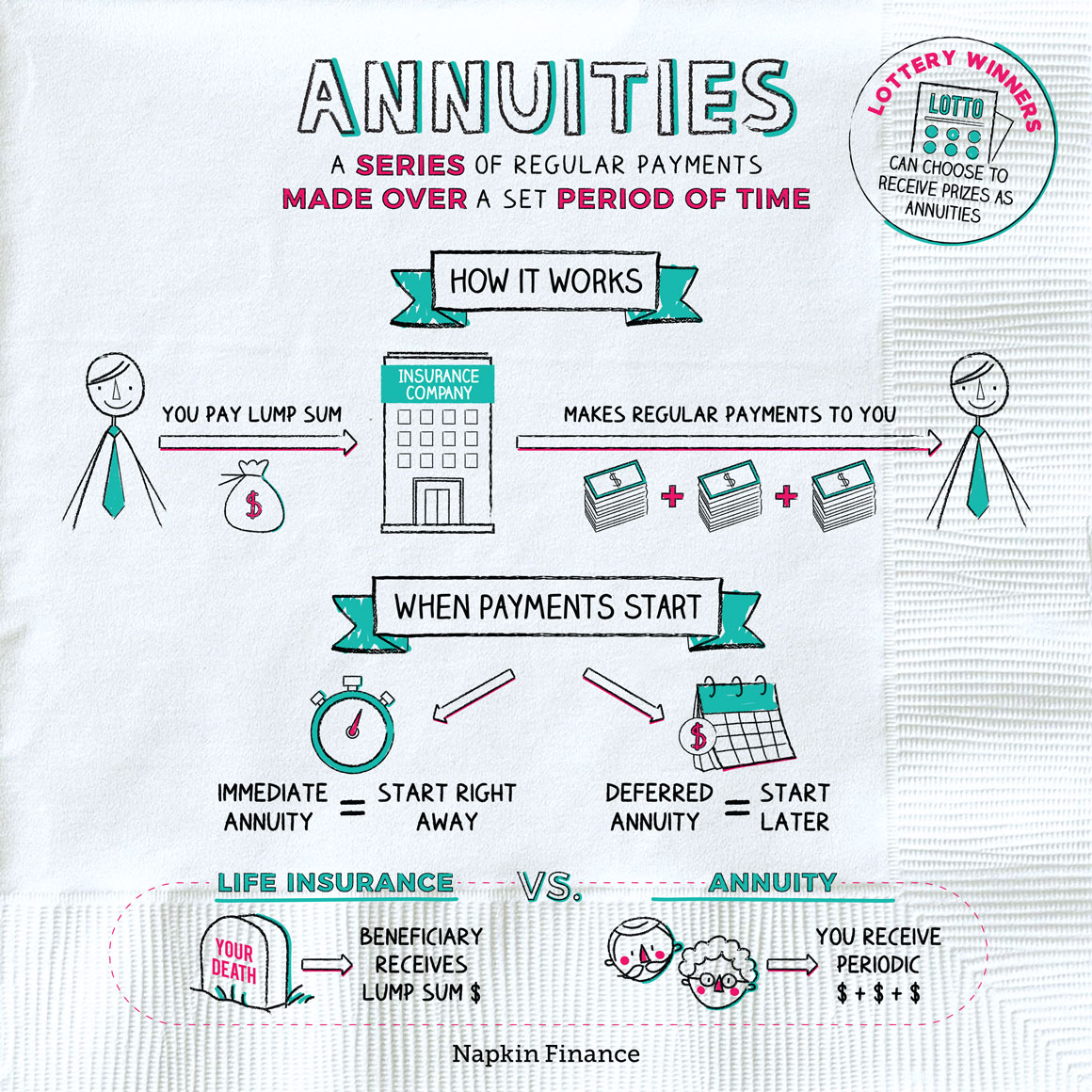

What Are Annuities Napkin Finance

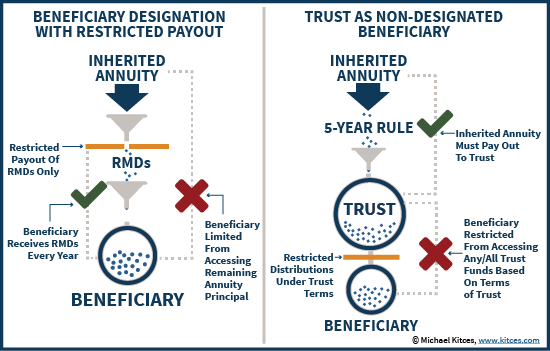

Using Annuities For Spendthrift Protection In Estate Planning

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Difference Between Annuitant And Beneficiary Difference Between

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Annuity Beneficiaries Inherited Annuities Death

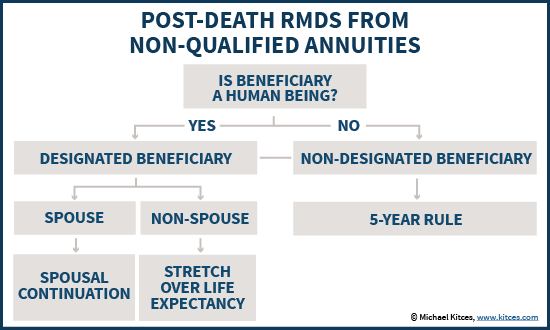

Trust Vs Restricted Payout As Annuity Beneficiary

Annuities From Protective Life Guaranteed Retirement Income

Living Abroad What About My South African Family Trust Family Trust South African South

Trust Vs Restricted Payout As Annuity Beneficiary

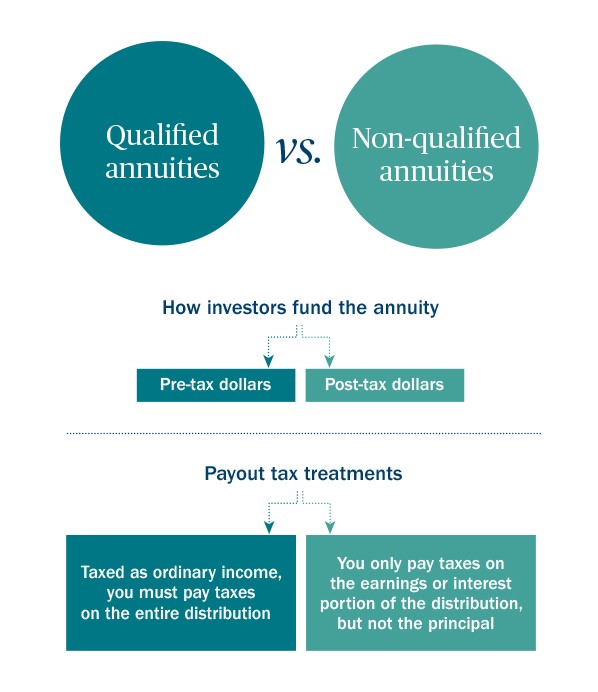

Annuity Taxation How Various Annuities Are Taxed

Beneficiaries Pay No Taxes On Non Registered Annuities Annuity Quotes Annuity Life Insurance Quotes